As the financial landscape continues to evolve, staying updated on the top finance research topics for 2025 is crucial for professionals, academics, and businesses. From fintech innovations and ESG (Environmental, Social, and Governance) investing to advanced financial modeling, this article explores the most relevant and impactful areas of finance research for the coming year. Dive into these topics to stay ahead in the ever-changing world of finance.

Which Topic is Best for Research in Finance?

Choosing the right topic for financial research can uncover valuable insights and address pressing issues in the field. Here are some promising areas to explore in 2025:

Fintech Innovations

- The impact of blockchain on banking systems.

- Artificial Intelligence (AI) in portfolio management.

- Decentralized Finance (DeFi) and its implications for traditional markets.

ESG Investing

- How ESG ratings influence investor decisions.

- The role of green bonds in sustainable finance.

- Measuring the financial impact of climate risks.

Risk Management

- Strategies for managing geopolitical risks in investments.

- Advanced modeling of market volatility.

- Cybersecurity risks in financial institutions.

Behavioral Finance

- How cognitive biases affect investment decisions.

- The psychology of cryptocurrency investors.

Macroeconomic Impacts

- Effects of monetary policy shifts on global markets.

- Financial repercussions of post-pandemic recovery strategies.

How to Find NPV (Net Present Value)?

Net Present Value (NPV) is a core financial metric used to evaluate the profitability of an investment by comparing the present value of cash inflows and outflows.

Formula:

Where:

- t = Time Period.

- r = Discount Rate.

Step-by-Step Guide:

- Identify Cash Flows: Determine the expected cash inflows and outflows for each period.

- Choose a Discount Rate: Use the cost of capital or an appropriate rate to discount future cash flows.

- Discount the Cash Flows: Divide each cash inflow by (1 + r)^t to find its present value.

- Sum the Discounted Values: Add the discounted cash flows and subtract the initial investment.

Example:

- Initial Investment: $100,000

- Annual Cash Inflow: $30,000 for 5 years

- Discount Rate: 10%

Using the formula, calculate the discounted cash flows for each year and subtract the initial investment to find the NPV.

Key Insight:

- Positive NPV: The project is profitable.

- Negative NPV: The project is not viable.

What is an Investment Decision?

An investment decision involves evaluating, prioritizing, and allocating resources to projects or assets with the goal of generating returns.

Types of Investment Decisions:

- Capital Budgeting: Long-term decisions about acquiring fixed assets like machinery or real estate.

- Portfolio Management: Allocating funds across stocks, bonds, or other investment vehicles.

- Expansion Decisions: Choosing to enter new markets or scale existing operations.

Factors Influencing Investment Decisions:

- Risk and Return: Balancing potential profits with associated risks.

- Market Trends: Identifying sectors or assets poised for growth.

- Company Objectives: Aligning investments with strategic goals.

What is a Liquidity Decision?

A liquidity decision focuses on ensuring a business has sufficient cash or easily convertible assets to meet its short-term obligations.

Importance of Liquidity:

- Operational Stability: Enables smooth day-to-day operations.

- Crisis Management: Provides a buffer during economic downturns.

- Creditworthiness: Improves relationships with lenders and creditors.

Common Liquidity Metrics:

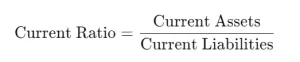

- Current Ratio:

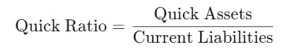

- Quick Ratio (Acid-Test):

Businesses with strong liquidity can invest in opportunities without jeopardizing their financial health.

What Are Good Topics to Study in Finance?

The dynamic nature of finance offers fertile ground for study and innovation. Key topics for 2025 include:

Financial Modeling

- Building predictive models for business forecasting.

- Using machine learning to improve financial projections.

Blockchain and Cryptocurrency

- The impact of central bank digital currencies (CBDCs).

- Regulation of crypto markets and its effect on adoption.

Quantitative Analysis

- Algorithmic trading strategies.

- Developing risk models for financial derivatives.

Corporate Finance

- Strategies for mergers and acquisitions.

- Evaluating the financial impact of corporate restructuring.

International Finance

- Exchange rate fluctuations and their effects on global trade.

- Trends in cross-border investments.

Conclusion

Research and analytical skills are essential for navigating the complexities of modern finance. Whether you’re exploring fintech innovations, mastering NPV calculations, or delving into liquidity and investment decisions, understanding and applying financial principles remains a crucial asset in 2025.

By embracing these topics and tools, you can stay ahead in the ever-evolving financial landscape.

Stay informed, Stay profitable.