Safaricom PLC, a giant in the Kenyan telecommunication industry, has been given regulatory approval to raise up to Ksh40 billion through a new corporate bond program. Marking a major move into the local debt capital market.

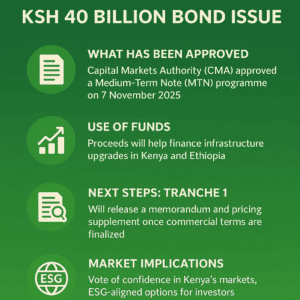

The approval was granted on November 7, 2025, by the Capital Markets Authority (CMA) to Safricom PLC to establish a medium-term note (MTN) program. Instead of issuing a single bond, Safaricom PLC may issue different “notes” in several tranches under this program.

Green bonds, social bonds, and sustainability-linked bonds are among the bond types it may issue, giving Safaricom the freedom to match the debt with social or environmental initiatives.

Utilization of funds

Safaricom claims that the money raised from the bond sale will support infrastructure improvements in Ethiopia as well as Kenya.

This implies that by enhancing its network capabilities throughout its geographical reach, the company is aiming for long-term growth.

Next Steps: Tranche 1

- Safaricom intends to launch the program with “Tranche 1,” for which it will publish a pricing supplement and an information memorandum. The terms “interest rate,” “maturity (tenor),” and “investor participation” will be described in detail in the information memorandum.

- The company notes that the final commercial terms and CMA approval of the pricing supplement are prerequisites for the issuance of the first tranche.

- Once Tranche 1 is ready for the market, Safaricom has promised to provide additional updates.

Strategy Timing

This is a good time for Safaricom to enter the bond market, according to observers.

- Kenyan interest rates have decreased as a result of Central Bank Rate (CBR) reductions.

- When compared to previous foreign-denominated borrowing, the MTN’s structure offers Safaricom greater flexibility and lessens its exposure to currency risk.

- Importantly, this action is in line with Kenya’s market trend, where big businesses are using the debt market more frequently. Safaricom’s action follows the launch of its own MTN program by East African Breweries (EABL).

Market Implications.

This program’s approval is an endorsement of Kenya’s financial markets. Given that Safaricom is one of Kenya’s largest and most stable businesses, institutional and individual investors may be drawn to the company’s decision to raise significant amounts of domestic debt.

Safaricom is also aligning with ESG (Environmental, Social, and Governance) financing trends, which are gaining popularity among local and international investors, by offering green sustainability-linked notes.

Raising long-term, fixed-rate local currency debt instead of depending on foreign loans, which carry currency risk, could help Safaricom optimize its debt profile for its own balance sheet.

Risk to consider

- The interest rate environment might change; if rates increase later, Safaricom might have to pay more for coupons on subsequent tranches.

- Investors face credit risk because corporate bonds are intrinsically riskier than sovereign debt, despite Safaricom’s strength.

- Execution risk: The success of the first tranche is contingent upon the attractiveness of its terms (tenor, coupon rate) and the market’s reaction to the information memorandum.

In conclusion

Safaricom’s KSh 40 billion bond program is a risky and calculated wager. It takes advantage of favorable local market conditions, capitalizes on investor appetite for ESH-aligned instruments, and promotes the company’s long-term growth, particularly in infrastructure. If done right, it could expand Kenya’s corporate debt market and provide Safaricom with a stable source of funding for its growth.