The National Hospital Insurance Fund (NHIF)’s medical claim payouts have reduced by 4.51 billion Kenyan Shillings. The drop which is the first in 15 years came about as a result of patients avoiding going to hospitals for fear of contracting Coronavirus.

According to data by the National Hospital Insurance Fund (NHIF) 52.04 billion Kenyan Shillings was paid out for medical claims in the year which ended on the 30th of June 2021. This is significantly lower than the 56.55 billion Kenyan Shillings that was spent during a similar period in 2020, and is as a result of a reduction in the number of visits to hospitals that was experienced in Kenya.

The eight (8) percent reduction in claims that were paid out, has occurred during a period in time when visits to hospitals went through a 60.4 percent drop to 1.871 million from the 4.724 million that was the case during the previous financial year.

Insurance providers have on numerous occasions been at odds with hospitals as a result of a number of allegations touching on inflated bills and fraudulent claims.

Visits from outpatients dropped to 1.23 million from 2.81 million while the hospital admissions experienced a reduction to 638,470 from 1.5 million leading to a reduction in payouts by the National Hospital Insurance Fund (NHIF).

This is also the first time in at least 15 years that the payouts by the National Hospital Insurance Fund (NHIF) have reduced. The last time a drop in payouts occurred was in the financial year which ended in June of 2006.

The number of days a patient spent in the hospital on average during the financial year or period under review was 2.2 days compared to the 3.8 that was the case in the previous financial year.

The occurrence is also the case for private insurers who the reduction in hospital visits enabled the medical underwriters to return an underwriting profit of 1.3 billion Kenyan Shillings for the year which ended in December of 2020, from a loss of 75.14 million Kenyan Shillings that was the case in 2019.

Official data created by the Insurance Regulatory Authority (IRA) revealed that claims increased by three (3) percent to 21 billion Kenyan Shillings while premiums increased by six (6) percent to 44.9 billion Kenyan Shillings.

For the health facilities the recent drop in hospital visits has led to a corresponding drop in revenues. The situation resulted in said facilities carrying out a number of salary cuts and layoffs.

The drop in payout claims helped ease off the pressure that the National Hospital Insurance Fund (NHIF) was experiencing due to the still ongoing Coronavirus pandemic. It had posted a drop in its premium collections as not less than half of its registered members defaulted on their payments.

The National Hospital Insurance Fund (NHIF) ended June 2021 with a total of 13.37 million dependents and 10.13 million members. This translates to a coverage of around 49.3 percent of the total population in Kenya.

In the words of the National Hospital Insurance Fund (NHIF), “This shows that several Kenyans have high exposure to out-of-pocket expenditure, thus are vulnerable to severe consequences of healthcare access and utilisation that are especially catastrophic for the poor.”

In the formal sector where members pay anything between 150 Kenyan Shillings per month and 1,700 Kenyan Shillings per month depending of course, on their respective salary scales, a total of 4.54 million members has been achieved. For the informal sectors, 5.59 million members has been attained.

According to Business Daily Africa 50.3 percent (5.1 million) of National Hospital Insurance Fund (NHIF)’s members are actively paying premiums, signifying a reduction in the premiums being received by the insurance fund.

Around a quarter of the members in the formal sector (1.29 million members), were inactive and 74.7 percent (3.81 million members) of the total informal sector members had not been contributing their monthly premiums of 500 Kenyan Shillings per month.

According to the National Hospital Insurance Fund (NHIF), “The informal sector has the lowest active membership of 74.7 percent due to individuals in the informal sector defaulting in payments, being accelerated by the effects of the Covid-19 pandemic.”

The defaults in contributions resulted in the premiums which were collected for the financial year that ended in June of 2021 dropping from 58.61 billion Kenyan Shillings to 57.18 billion Kenyan Shillings, its first decline in 18 years.

The premiums that were collected amounted to 89 percent of the 64.49 billion Kenyan Shillings target which the National Hospital Insurance Fund (NHIF) had planned to collect during the financial year. The 64.49 billion Kenyan Shillings target was as a result of the increase in members that it experienced.

The National Hospital Insurance Fund (NHIF) ended the financial year with a loss ratio of 91 percent, a feat which is lower than the 93 percent that was the case in the previous financial year. The loss ratio constitutes the claims paid along with the expenses as a portion of earned premiums.

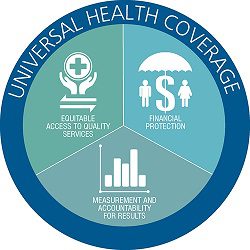

The East African nation of Kenya has made the actualization of the Universal Health Coverage (UHC) by 2022 a priority. This is after numerous stops and starts over the years.

The Kenyan government wants the Universal Health Coverage (UHC) to be mandatory nationwide for all Kenyans irrespective of their economic statuses. It expects that the National Hospital Insurance Fund (NHIF), will be in charge of the Universal Health Coverage (UHC)’s management.

It has pledged to sponsor one million poor households at the beginning of the Universal Health Coverage (UHC) national scheme.

The Parliamentary Committee on Health recently put a halt to the plans when it pointed out clauses in the National Hospital Insurance Fund (NHIF) (Amendment) Bill. Said clauses who have made it compulsory for all Kenyans above the age of 18 to contribute.

The National Treasury in the February Budget Policy Statement for the fiscal year from 2021 to 2022 made it known that plans to launch the health insurance which will be backed by the Kenyan Government are at an advanced level. It added that the collection of the data of beneficiaries, is already underway.

How informative was this article? Are there any other news topics, categories, or How To topics, that you would like us to write on? Feel free to reach out to Mpesa Pay in the comment section.