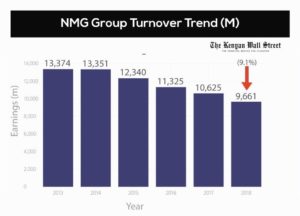

Nation Media Group (NMG) has cut its dividend in half after a sharp fall in its full year 2018 income.

The media firm also made it known to its investors, that its strategy to monetize its digital footprint would take time. Net income for the period fell by 21.8 per cent to 1.035 Billion Kenyan Shillings while pretax profit fell by 16.4 percent.

The media house giant, attributed the decline to a operating environment that became difficult particularly in Kenya, Uganda, and Tanzania, which are its main markets. Wilfred Kiboro, Nation Media Group’s chairman, stated that the print business, which contributes over 90% of the total income, continues to face digital disruption.

Nation Media Group’s management also announced plans to introduce a paywall for some of its online content as another way to generate more revenue.

According to the firm its decision to halt government advertisements, negatively affected its revenue stream. This is because said government advertisements, contribute around 33 percent of its advertising revenue. Nation Media Group in July 2018, announced that its decision to stop government advertising, was as a result of delayed payments. It has however, since resumed business with the Government and is at the same time, working towards reducing its reliance on such advertising.

The Media House’s Finance Director says that an estimated 1.2 billion Kenyan Shillings of the company’s cash, is held by both some county governments and the national government.

Nation Media Group’s cash flow from operations also saw a decline to KSh2 billion from KSh3 billion.

Given the steady decline in revenue, Nation Media Group cut its 2018 dividend by half to a total dividend payout of KSh5.00 per share from the KSh10.00 dividend it had been paying since 2012.

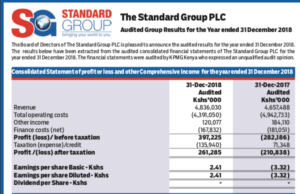

Standard Group

Standard group on the other hand, is reportedly now back to profitability after it recorded profits of 397 million Kenyan Shillings before tax, marking a shift from the 282 million Kenyan Shillings loss it recorded in 2017. The media giant has attributed its improved earnings to efficient operations, which are as a result of its switch to automation and effective use of resources.

The company’s revenues rose slightly by 4 per cent to 4.8 billion Kenyan Shillings, due to impressive performances in the different revenue streams.

By automating most of its operations as well, Standard Group managed to bring down its total operating costs by 11 percent from 4.9 billion Kenyan Shillings (recorded the previous year), to 4.4 billion Kenyan Shillings.

In a statement by Standard Group sent through the exchange, the company’s receivables jumped up 7 percent due to debt owed by the government and its other major clients.

Standard group’s total assets also grew by 5 percent to reach 4.7 billion Kenyan Shillings, while its short term debt declined by 1 percent. The company’s long term debt however, jumped up 40 percent but its long term debt is only 20 percent of the group’s total debt.

Standard group’s provisions for debt have also increased by 74 percent.

Its directors are optimistic about the company’s performance in 2019, reaffirming its commitment towards engaging with customers and also providing products which will meet market requirements.

The directors also proposed a 0.6 Kenyan Shilling dividend per share for the financial year 2018.

With Standard Group bouncing back, all hope is not lost for Nation Media Group.