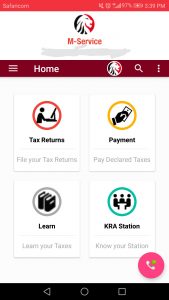

The Kenya Revenue Authority (KRA), has launched a brand new mobile application. This mobile app will make it possible for taxpayers to be able utilize tax services directly from their smartphones.

With the mobile app called the ‘KRA M-Service App’ all users will be able to carry out PIN registration as well as the required verification processes.

Users will also be able to carry out their tax payments and also file returns directly from the KRA M-Service App.

The KRA M-Service App is available to and can be utilized by any taxpayer. All you need to do is have an android mobile device. From there the application easily be downloaded from Google’s Android Play Store.

The Kenya Revenue Authority (KRA)’s Deputy Commissioner for Policy and Tax Advisory at the Domestic Taxes Department revealed that the new application will make it possible and much more convenient for taxpayers to efficiently handle all their tax obligations even when they are on the move.

He added than more than 100,000 Kenyans, have already downloaded the mobile application.

The Kenya Revenue Authority (KRA) is also actively working with a number of other software developers so as to make the KRA M-Service App available on Apple’s App Store as well and before the end of 2020.

The Kenya Revenue Authority (KRA) expects that this new platform will help it further expand its reach, ensure tax compliance and result in an increase in revenue collection.

The tax authority also aims to gradually introduce more functionalities to the KRA M-Service App alongside a USSD version for domestic taxes and a version of the application that will be in Swahili.

The KRA M-Service App is linked to the Integrated Customs Management System (iCMS). This will make it possible for exporter and importers to execute functions like filling out Customs Entry Declaration Status and Passenger Declaration Forms.

Are there any other topics, news or categories that you would like us to write on? Feel free to reach out to Mpesa Pay in the comment section.