Mobile lending has become a very popular practice in Kenya. Its growing popularity and easy accessibility, has led to a boom in the number of mobile loan services available in the country, as a direct response to the ever growing demand present here..

One of such mobile loan services available in Kenya, is Kuwazo and in this festive season, this information might just come in handy. Especially now that it is just a day before Christmas.

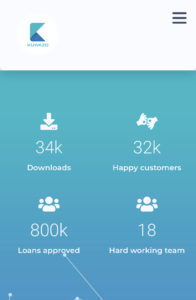

Kuwazo is one of the fastest growing mobile loan lenders in Kenya. The loan provider has 34,000 downloads for its mobile app, 32,000 users so far and 800,000 loans which have been approved.

What You Should Know About Kuwazo Loans

Below are certain things you should know about Kuwazo i.e, the features as well as the requirements for your loan application:

- Kuwazo does NOT require its users to pay any registration fee in order to gain access to loans or activate their accounts.

- Kuwazo gives its users loans of up to 30,000 Kenyan Shillings.

- Kuwazo has a loan repayment option called ‘Lipa Pole Pole’ where its users if they choose the option, will be able to pay back their loans in installments.

- You must be residing in Kenya in order to be eligible for a loan from Kuwazo.

- You must have a Passport number or Kenyan ID.

- You must have an Android mobile device that can successfully download and install the Kuwazo mobile app.

- You do not need to have a bank account or any form of collateral in order to acquire a loan from Kuwazo.

- A good repayment history will ensure that you will qualify for bigger loans from Kuwazo.

- Your loan once approved, will be sent directly into your Kuwazo account. You can then proceed to transfer the loan amount to your M-Pesa mobile money wallet.

How To Apply For An Kuwazo Loan Via The Kuwazo App

To apply for an Kuwazo loan via the loan provider’s mobile app, simply:

- Go to Google Play Store on your android device and search for ‘Kuwazo’. Alternatively, you can download the Kuwazo Mobile app via this link: https://play.google.com/store/apps/details?id=com.pesapap.microloan&hl=en

- As soon as you are done downloading the Kuwazo application on your android mobile device, proceed to install and launch the application.

- Once done, create your account by typing in the required details.

- Confirm your mobile phone number.

- Next, proceed to apply for your Kuwazo loan.

- Proceed to submit.

How To Repay Your Kuwazo Loan Via M-Pesa

To repay your Kuwazo loan via M-Pesa Paybill, simply use the following steps:

- Go to your M-Pesa via your Safaricom SIM Toolkit.

- Once there, select the ‘Lipa na Mpesa’ option on the menu.

- Next, select the ‘Paybill’ option.

- In the field labelled as ‘Paybill Number’, type in 149719. This is the official Paybill number for Kuwazo.

- Next, in the field labelled as ‘Account Number’, type in your M-Pesa phone number.

- Once done, type in the loan amount that you would like to repay. Remember Kuwazo also has the option of paying back loans in installments.

- Type in your unique M-Pesa pin.

- Again, please make sure that all the details you provided are accurate, especially the Paybill Number and of course your phone number. After making sure the details are correct, proceed to submit your payment by selecting ‘Ok’.

You can also carry out your loan repayment by selecting the Repay button in the Kuwazo mobile app.

How To Contact Kuwazo’s Customer Care Service

If you are however in need of further assistance from Kuwazo, please feel free to reach out to the loan provider’s customer care via the following channels:

- Their official SMS and WhatsApp ONLY Phone Number: +254740279971

- Their official email address: talktous@kuwazo.co.ke

- Their official website: https://kuwazo.co.ke