In a move seen by many as a way to protect its users from predatory lending, Google has unveiled a new policy for mobile loan applications.

The new developer policy is aimed at restricting developers from creating mobile applications which encourage reckless borrowing.

Such policies are coming at a time when the Play Store is beyond saturated with mobile lending apps, mostly from Kenya.

The decision by Google, mirrors the general concern regarding the growing number of malpractices on lending platforms.

Although the tech giant had policies in the past, which banned applications that expose mobile users to harmful financial services, the new regulations will however provide deeper insights.

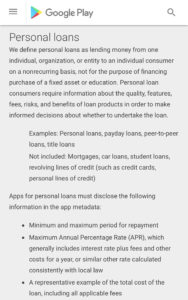

The Play Store for example, now requires developers to provide information about the quality, features, features as well as the benefits of their personal loan products. The information will then be used to help consumers, make informed choices when taking or applying for loans.

Google’s new policy is a huge blow all the apps that offer predator like quick fixes via short term personal loans. Such apps often advertise enticing loan amounts with minimal documentations. Yet, most of the same mobile loan apps avoid revealing the true costs as well as the recovery processes for the loans. Applications which require full loan repayments in 60 days, have now been restricted.

The new developer policy reads, “We do not allow apps that promote personal loans which require repayment in full in 60 days or less from the date the loan is issued (we refer to these as “short-term personal loans”).”

The new regulation is also expected to check unnecessary borrowing m which is stimulated by sugar-coated loan app descriptions.