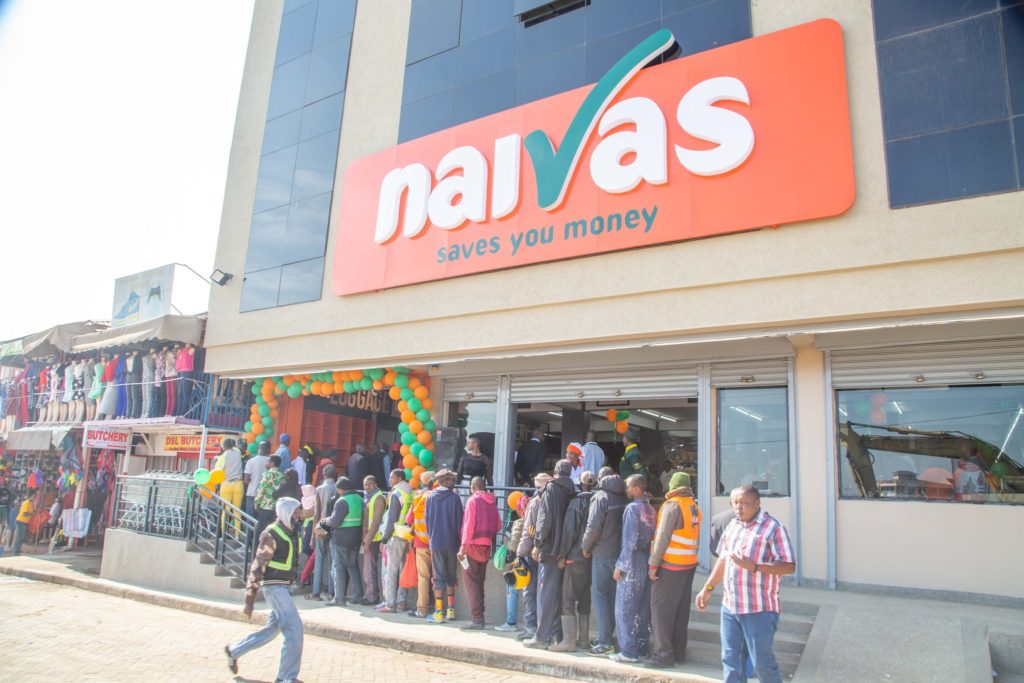

A consortium made up of France based private fund; Amethis and the World Bank’s International Finance Corporation (IFC) have sold off a thirty (30) percent stake in Naivas Supermarket which is also Kenya’s Largest Online Supermarket and Grocery Delivery Service. The thirty (30) percent stake was sold to a group of investors spearheaded by IBL Group which is a conglomerate based in Mauritius.

Although World Bank’s International Finance Corporation (IFC) along with its partners; Amethis, MCB Equity Fund, DEG which is a sovereign wealth fund based in Germany have not revealed the value of the transaction, the consortium had paid a total of 6 billion Kenyan Shillings back in April of 2020 for the acquisition of the minority stake.

It is however believed that the group are selling away their shares for a significantly bigger sum than the 6 billion Kenyan Shillings they were purchased at. IBL Group made it known that this particular deal, is the highest value transaction it has ever been involved in.

Read Also: Naivas Supermarket Set To Be WaterFront Mall’s Anchor Tenant

This occurrence highlights the worth of Naivas Supermarket which continues to be the main draw for private equity funds in Kenya operating in the retail sector. The sector continues to feel a significant space where one of the retail giants, fell.

IBL Group made it known via a statement that, “The investment in Naivas International [the owner of the retail chain] is the biggest investment in IBL’s history.”

IBL Group has now put together a group of institutional investors with the aim of buying out the consortium led by the World Bank’s International Finance Corporation (IFC).

IBL Group’s partners are DEG from Germany and Proparco from France. The transaction will be a simultaneous exit and re entry into Naivas Supermarket for both sovereign wealth funds.

Read Also: Masks Now Mandatory Indoors In Kenya

According to reports, the new deal will not involve any fresh influx of capital into Naivas Supermarket after the initial 6 billion Kenyan Shillings back in 2020 resulted in the supermarket giant expanding aggressively in a sector in Kenya which is very competitive, and has continued to attract international big players like the Carrefour franchise which is backed by Majid Al Futtaim.

The family of the late Peter Mukuha Kago who is the businessman who founded Naivas Supermarket, will continue to have a controlling stake in the business.

The exit of the World Bank’s International Finance Corporation (IFC) led consortium is a surprisingly brief investment duration for institutional investors. This is because those types of companies typically maintain investments for seven (7) or more years.

The IBL Group made it known that the proposed deal will make it possible for it carry out more investments in the East African region, stating that Naivas Supermarket has greatly increased its operations further cementing its claim as the largest Supermarket in Kenya.

Read Also: Soap and Cooking Oil Shortage Expected Following Palm Export Ban Threats

The Chief Executive Officer (CEO) of IBL Group; Arnaud Lagesse made it known via a statement that, “This family business created in 1990 is an example of a success story that has continued to grow despite the pandemic thanks to its strong business model.”

He added that, “With 84 outlets in 20 cities and towns across Kenya, it has put modern grocery retail within everyone’s reach. Naivas also contributes to the Kenyan economy, notably by employing over 8,000 people.”

According to the Chief Executive Officer (CEO), IBL Group has the proficiency within the retail sector as it also operates the Winners Supermarket chain in Mauritius.

Naivas Supermarket has in recent years, evolved into becoming one of Kenya’s biggest companies by employment as well as by sales.

It is projected that Naivas Supermarket will be closing the financial year which will end this month, with a total revenue of 860 million United States Dollars which is around 101.39 billion Kenyan Shillings. It aims to hit 1 billion United States Dollars which is around 117.85 billion Kenyan Shillings during the next financial year.

At the the time when the World Bank’s International Finance Corporation (IFC) led consortium bought into Naivas Supermarket the establishment had just sixty (60) stores.

The Supermarket used the cash generated from the buy in, to set up more branches and also take over the premises which were previously occupied by its competitors like Nakumatt Holdings and Tuskys which is owned by Tusker Mattresses Limited.

The nearest rival to Naivas Supermarket in terms of sheer branch network is Quick Mart which is majority owned by Adenia Partners. As at April of 2022, Quick Mart had fifty one (51) stores. It has also been undergoing intensive aggressive expansion moves since it received investment from Adenia Partners which is a private equity company that focuses on Africa.

The Carrefour franchise which is backed by Majid Al Futtaim has a total of around sixteen (16) branches and posted substantial revenue of 33 billion Kenyan Shillings in 2021. Carrefour benefits from more spending power per shopper in the affluent suburbs where its branches are usually located at.

Read Also: Introducing Safaricom and Visa’s M-Pesa GlobalPay Virtual Card

When the World Bank’s International Finance Corporation (IFC) led consortium got into the market the value of Naivas increased to 20 billion Kenyan Shillings. It is expected that the new deal will grow the value of the Supermarket brand even more.

The Managing Director of Naivas; David Kimani made it known via a statement that, “This is an exciting partnership by our shareholders that will drive us to the next phase of growth. We appreciate the immense knowledge and capacity in the retail industry that IBL brings to the table.”

IBL Group’s purchase of a minority stake in Naivas signifies the further growth of its business model of conglomeration spreading across eighteen (18) countries.

How informative was this particular article? Are there any other news topics, categories, or How To topics, that you would like us to write on? Feel free to reach out to Nexbit KE in the comment section.