The drop is attributed to an increase in fixed deposits from businesses and wealthy investors during a period which saw a number of restrictions implemented to help reduce the spread of the still ongoing Coronavirus pandemic. Said restrictions led to a significant drop in investment opportunities and also reduced the demand for loans.

Interests on fixed deposits also reduced to an 8 year low and is proof of the reduced appetite for savings by bankers, as well as a drop in the demand for loans.

The drop in returns on savings in 2020 had a negative impact on business and investors with high net worths and led to them deciding to hold on to their money. This eventually led to bank accounts piling up.

The Chief Executive Officer (CEO) of the Kenya Bankers Association; Habil Olaka said, “Generally a decrease in the rate shows decreased appetite for the banks to mobilise funding for onward lending.”

The Chief Executive Officer (CEO) added that, “When demand for loans is not high, banks prefer not to keep deposits that they are not going to lend, but when loan uptake improves, the ripple effect is that banks will offer more returns for savings.”

A significant number of savings accounts do not accrue interests as a result of the fact that most banks have put in place a threshold slow which they accept deposits for free.

The interest rate on savings also reduced in December 2020 to 2.7 percent. This is a 5 year low and also much lower than the 4.25 percent that was the case in January of 2020.

It is also a sharp contrast especially when compared to the year 2018 when interests on savings accounts, had an average of 6.37 percent.

Banks in Kenya have also begun to implement a careful approach towards extending new credit at a period when individuals and businesses alike, are looking for abeyance on their loans as the country continues to deal with the ongoing Coronavirus pandemic.

In a bid to cut down on losses, numerous businesses have reduced their production. A decision that has subsequently led to unpaid leaves for staff, as well as significant loss of jobs.

Affected employees who had utilized mortgages, loans that were not secure in order to cater for school fees, and or purchase goods, have so far been defaulting on their loans.

A number of these loans were granted to employees based on their salaries. Businesses who had received loans based on projections of their incomes, have also had trouble repaying their loans.

Due to this, various banks have slowed down on providing loans, which in turn reduced the rush for deposits that had put pressure on the interest said banks paid on savings.

According to Business Daily Africa, major companies and investors alike who we’re looking for how to protect their wealth, proceeded to stockpile billions of Kenyan Shillings in 2020.

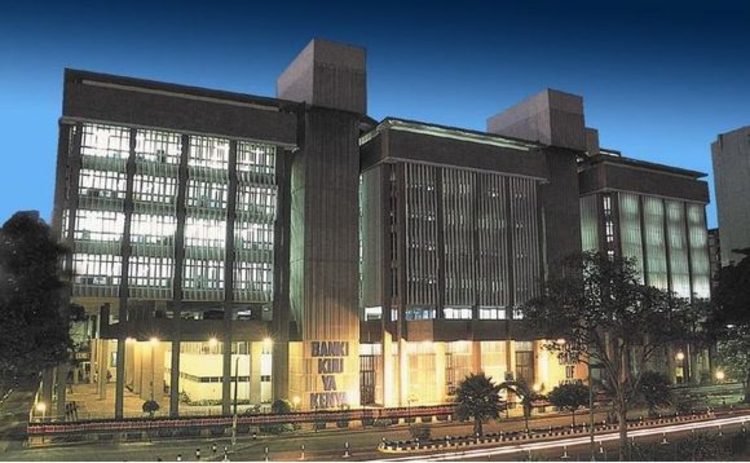

Data by the Central Bank of Kenya (CBK) revealed that deposits in 2020 increased by 467.5 billion Kenyan Shillings and net lending increased to 223.4 billion Kenyan Shillings.

Fixed deposits also increased by 150 billion Kenyan Shillings to an impressive 1.53 trillion Kenyan Shillings. This is the highest increase since 1995 when data regarding savings, began to be recorded.

This is proof that individuals have begun protecting their wealth instead of looking for new avenues to invest said wealth.

The increase in deposits in Kenya came shortly after the East African nation announced it’s first Coronavirus cases and subsequently put in place tough restrictions among which was the dusk to dawn curfew.

Demand in Kenya’s export markets as well as its local markets dropped drastically because consumers remained indoors in order to avoid contracting the Coronavirus and in accordance with the preventive measures put in place by numerous governments. Said preventive measures led to numerous investments plans, getting put on hold.

Low returns from real estate and numerous stock markets were also the norm for a period of time.

According to Business Daily Africa, the Chief Economist at Mentoria Economics; Ken Gichinga said, “Most business are still operating at around 40 percent of their pre-Covid-19 levels. If the hospitality and transport industries get their vibe back, the demand for loans will increase and the ripple effect is an increase in the deposits and the savings rate offered by banks to entice the public for onward lending.”

How informative was this article? Are there any other new topics, categories, or How To topics, that you would like us to write on? Feel free to reach out to Mpesa Pay in the comment section.